Quick jump

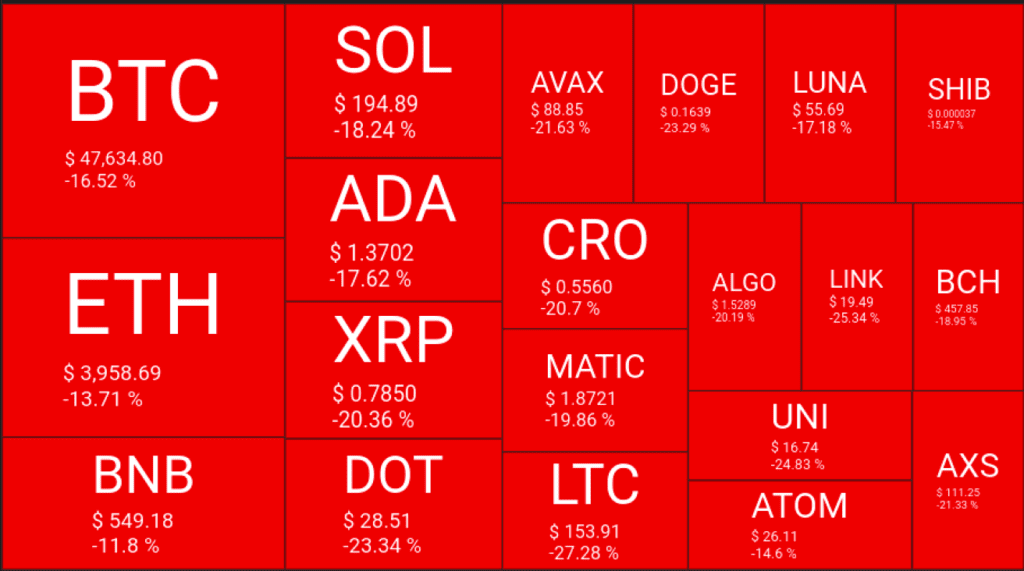

Bitcoin price lost nearly 20% in value on Saturday, giving up ground amid profit-taking and market uncertainties. This triggered a mass sell-off all across the cryptocurrency markets which drove the total value of bitcoin down to around $140 billion.

Bitcoin is slowly sliding down and hit $41,967.5 against the USD just a few hours ago. The rate has reached $47,996 again but it’s still less than yesterday’s value.

Ether prices tumbled 10% following Bitcoin price

The broad selloff in cryptocurrencies has seen Ether, the currency linked to Ethereum, plummet more than 10%.

As per the data, the cryptocurrency market has shrunk to $2.34 trillion and it is expected to continue declining in the near future. This decrease comes after a brief rise in November when Bitcoin’s value hit $69,000.

Also read:

- Crypto Exchange Kraken now has Shiba Inu! — SHIB Trading Begins Tomorrow

- The virtual currency exchange Coinstore enters India as the Centre is finalizing a crypto bill

- Govt. warns Elon Musk’s Starlink not a licensee; Don’t book satellite internet services

A lot of investors are following the volatility of global equities, US bond yields, and the Omicron variant of the coronavirus. This week has been particularly volatile with job growth slowing in November and people worried about the coronavirus.

Justin d’Anethan, head of exchange sales in Hong Kong at the cryptocurrency exchange EQONEX, has been watching how leverage ratios have risen across the cryptocurrency markets and how large holders have moved their coins from wallets. However, the latter is usually a sign of intent to surf

“Whales in the crypto space seem to have transferred coins to a trading venue, taken advantage of a bullish bias and leverage from retail traders, to then push prices down,” he said.

The selloff also comes ahead of testimony by major cryptocurrency executives before the US House Financial Services Committee on December 8. You can read our CEO’s thoughts on the matter here

The hearing will have a “star appearance” by major players in the crypto world, as the US officials deal with the regulatory implications of this new technology.

The US Securities and Exchange Commission (SEC) has rejected a second proposal for an exchange-traded fund (ETF) that tracks bitcoin.

Data from Coinglass has shown nearly $1 billion worth of cryptocurrencies has been liquidated in the last 24 hours. Most of this money was taken out from Digital Exchange Bitfinex.

“If anything, this is the opportunity to buy the dip for many investors who might have previously felt like they missed the boat. We can see tether bought at a premium, suggesting people are getting cash ready, within the crypto space, to do just that,” D’Anethan said, referring to the oldest & largest form of securely storing value in the cryptocurrency world

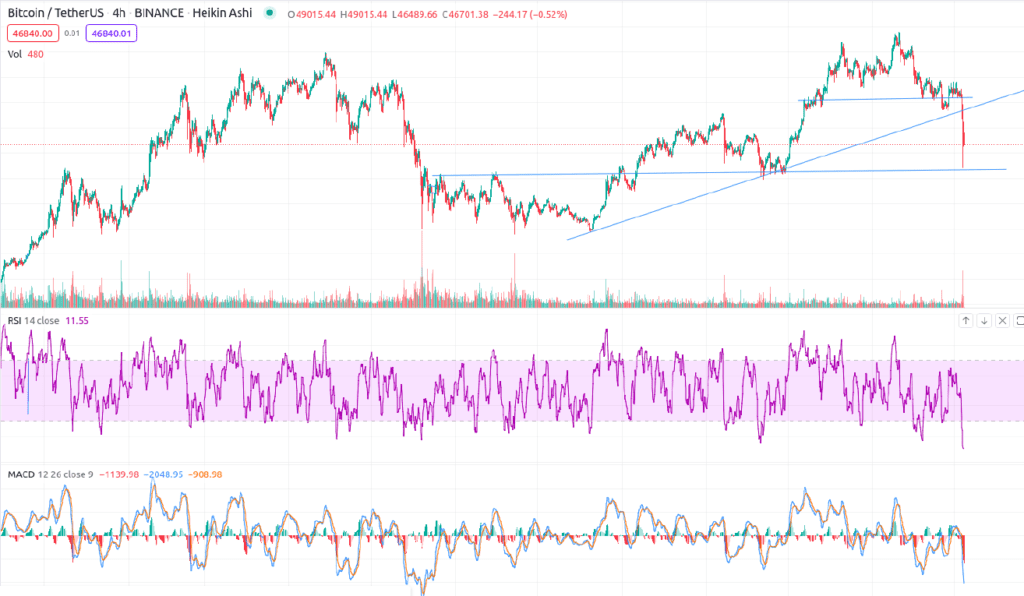

A drop in Bitcoin funding rates, which rose to 0.06% in October after trading around 0.027% for much of the year, reflects a general disillusionment among traders.

The rate at which you can lend your alt-coins to someone for short-term or medium-term periods has been going up in the cryptocurrency trading platform BitMEX.

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.